A Special Testicular Cancer Clinic Helps Patients Get Better, Safer Care

A Special Testicular Cancer Clinic Helps Patients…

Maulana Azad Medical College, Delhi, Rajiv Gandhi Cancer Institute, Delhi

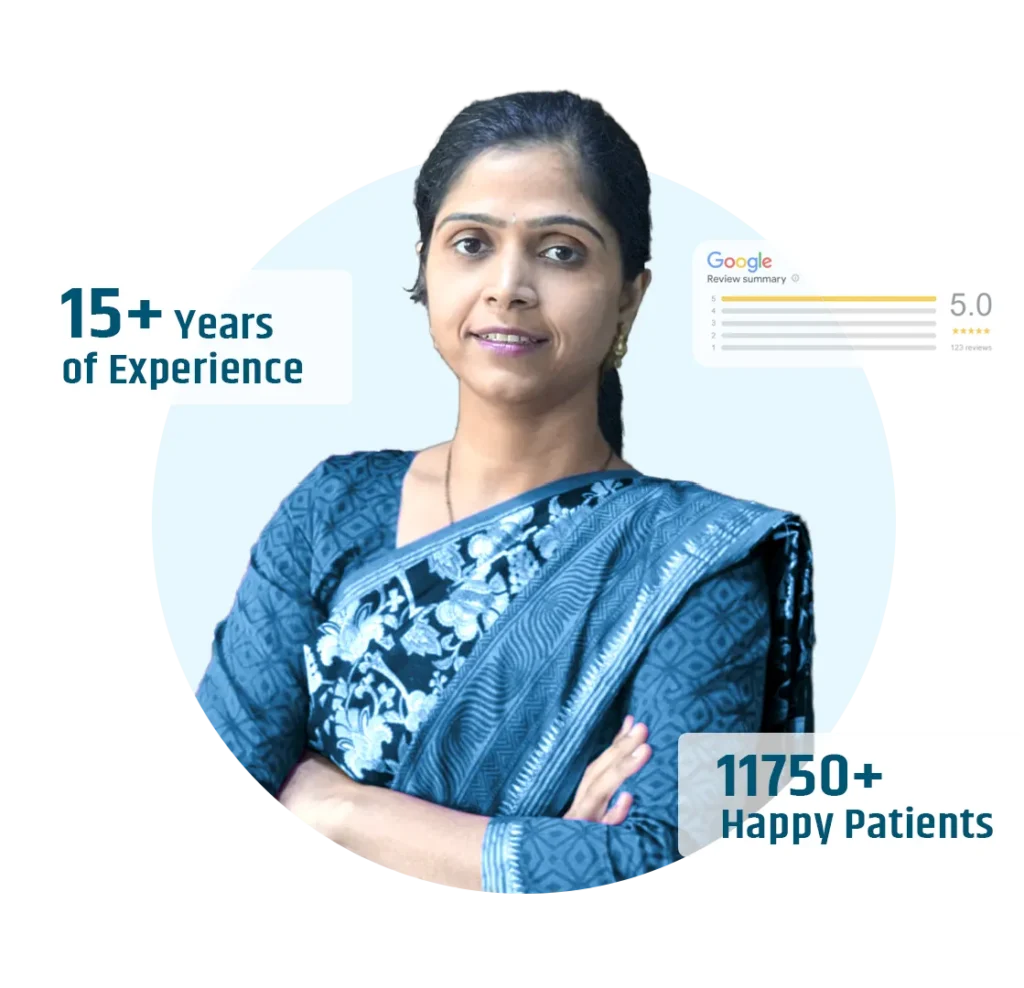

Holds the highest degrees in Oncology – DrNB, Surgical Oncology

◘ 15+ years in Cancer Surgeries

◘ 10+ years in Robotic Surgeries

◘ 10+ years in HIPEC

Maulana Azad Medical College, Delhi, Rajiv Gandhi Cancer Institute, Delhi

Holds the highest degrees in Oncology – DrNB, Surgical Oncology

◘ 15+ years in Cancer Surgeries

◘ 10+ years in Robotic Surgeries

◘ 10+ years in HIPEC

Dr.Swati Shah, Highly Qualified cancer specialist Doctor and icing on cake very Good human being. She understands her patient very well and also understands need of hour. My mother suffered from Cancer and worst part was my mother is mentally unstable having big issue was to make her understand. Dr. Swati Shah very well understood the situation and treated my mother with full of empathy and today She is cancer free.. Thanks Dr. Swati 🙏

I wish I would have had a doctor like you when I needed treatment. Your compassion and commitment to your patients is inspiring. As an cancer specialist your work is making such a large, positive impact on so many people's lives.

We truly thankful to Dr Swati Shah. She always support us. My mother had cancer she guided us for surgery . Surgery was done by her and now she feels good n healthy. Thanks a lot for my heart to Dr Swati Shah and her team. I heardly recommend expert cancer specialist Dr Swati Shah.

As a pioneer in the field, Dr. Swati Shah incorporates cutting-edge techniques at the Robotic Uro & Gynec Cancer Hospital. Her role as a Robotic Uro Cancer Surgeon and Robotic Gynec Cancer Surgeon underscores the hospital’s commitment to employing advanced technologies in cancer surgery. These techniques enhance precision, reduce recovery times, and contribute to improved outcomes for patients seeking cancer treatment in Ahmedabad.

At the cancer hospital, Dr. Swati Shah’s proficiency as a cancer doctor in Ahmedabad is evident in her adept handling of complex cases. Her commitment to providing advanced cancer treatment is reflected in the hospital’s state-of-the-art facilities, ensuring patients receive the best cancer treatment available.

Yes, we offer cashless treatment for cancer, including all Uro & Gynec cancers, ensuring a hassle-free process. For more details about insurance tie-ups and cashless facilities, please visit our Insurance Page.

1. Unusual bleeding or discharge: Blood in stool, urine, nipples, or unexpected vaginal bleeding.

2. Lumps or thickening: New lumps in breasts, neck, or elsewhere, or existing ones changing size or shape.

3. Changes in bowel or bladder habits: Persistent constipation, diarrhea, black stools, or trouble with urination.

4. Unexplained weight loss: Sudden weight loss without trying, often accompanied by fatigue.

5. Nagging cough or hoarseness: Persistent cough, difficult swallowing, or voice changes.

6. Sores that don’t heal: Non-healing ulcers on the skin, especially in the mouth or tongue.

7. Indigestion or difficulty swallowing: Heartburn, bloating, trouble swallowing, or feeling of fullness.

Cancer affects the body by causing abnormal cells to grow uncontrollably, forming tumors that can disrupt normal functions of organs. These tumors may invade surrounding tissues and spread (metastasize) to other parts, impacting overall health and bodily functions.

⦿ Healthy diet: Eat plenty of fruits, vegetables, and whole grains while limiting processed foods, sugary drinks, and red meat.

⦿ Regular exercise: Aim for at least 150 minutes of moderate-intensity exercise per week.

⦿ Maintain a healthy weight: Obesity increases the risk of several cancers.

⦿ Limit alcohol and tobacco: Both are known carcinogens and significantly increase cancer risk.

⦿ Sun protection: Use sunscreen and avoid excessive sun exposure to reduce skin cancer risk.

⦿ Vaccinations: Certain vaccines like HPV can prevent specific cancers.

⦿ Regular checkups: Early detection through screenings is crucial for successful cancer treatment.

⦿ Treatment outcomes: Different treatments affect patients differently. Some individuals experience minimal side effects and quickly get back to regular activities, while others face ongoing challenges.

⦿ Individual coping mechanisms and support systems: A positive attitude, strong support network, and access to resources can significantly impact someone’s ability to adapt and thrive despite their diagnosis.

⦿ Type and stage of cancer: Cancers have different prognoses and treatment options. Early-stage cancers often have better chances of successful treatment and a return to normalcy.

⦿ Treatment outcomes: Different treatments affect patients differently. Some individuals experience minimal side effects and quickly get back to regular activities, while others face ongoing challenges.

⦿ Individual coping mechanisms and support systems: A positive attitude, strong support network, and access to resources can significantly impact someone’s ability to adapt and thrive despite their diagnosis.

⦿ Tumor size (T): Bigger tumors denote higher stages.

⦿ Lymph node involvement (N): Spread to lymph nodes indicates progression.

⦿ Metastasis (M): Presence of cancer cells in distant organs signifies advanced stage.

⦿ Stage I: Early-stage, localized cancer with good prognosis.

⦿ Stage II: Cancer has grown slightly or spread to nearby lymph nodes.

⦿ Stage III: More advanced cancer, usually involving larger tumors or significant lymph node involvement.

⦿ Stage IV: Metastatic cancer that has spread to distant organs, typically with a less favorable prognosis.

A Special Testicular Cancer Clinic Helps Patients…

Could Ibuprofen Lower the Risk of Endometrial…

A New Combination Treatment May Help People…

If you have any kind of Uro & Gynec Cancer related medial emergency, visit Apollo Hospital. An expert doctor is always available & treatment will be provided at once.

If you have any kind of cancer related medial emergency, visit Apollo Hospital. An expert doctor is always available & treatment will be provided at once.